Binance Buy Bitcoin and Crypto APK is a popular application for acquiring Bitcoin and other cryptocurrencies. It simplifies the process, making it accessible to a broader audience. This guide delves into the app’s features, functionalities, and security measures, alongside exploring alternative options and broader Bitcoin purchasing methods.

The app streamlines the often-complex procedure of buying crypto, from download and installation to completing transactions. This comprehensive guide explores the nuances of using Binance Buy Bitcoin APK, comparing it to alternative methods and offering insights into the security considerations involved.

Introduction to Binance and Bitcoin

Binance is a globally recognized cryptocurrency exchange, facilitating the buying, selling, and trading of various cryptocurrencies, including Bitcoin. It’s renowned for its diverse trading options, user-friendly interface, and robust security measures. This platform caters to both novice and experienced traders, offering a wide range of tools and resources to navigate the cryptocurrency market.Bitcoin, the pioneering cryptocurrency, serves as a decentralized digital currency and a store of value.

Its innovative approach to peer-to-peer transactions and its limited supply have garnered significant attention and adoption in the financial world. The underlying technology of Bitcoin, blockchain, is a distributed ledger that records transactions across multiple computers, making it secure and transparent.

Relationship Between Binance and Bitcoin

Binance plays a pivotal role in the Bitcoin ecosystem. It provides a marketplace for Bitcoin trading, allowing users to buy, sell, and exchange Bitcoin for other cryptocurrencies or fiat currencies. This facilitates the liquidity and accessibility of Bitcoin for a broader audience.

History of Bitcoin

Bitcoin’s history traces back to the concept of a decentralized digital currency, with the first Bitcoin transaction occurring in 2009. Its evolution has been marked by periods of rapid growth, price volatility, and regulatory scrutiny. The underlying technology, blockchain, has been crucial in its development and continues to shape the evolution of cryptocurrencies. Early adopters and investors have witnessed both significant gains and substantial losses as Bitcoin’s value fluctuates.

Different Types of Bitcoin Transactions

Bitcoin transactions can be categorized into several types, each serving distinct purposes. A key distinction lies in the transaction’s speed and cost.

- Regular Transactions: These transactions are the standard method for transferring Bitcoin. They typically take a few minutes to a few hours to be confirmed on the blockchain, depending on network congestion. The fees associated with these transactions vary based on the current network demand. A user might choose a regular transaction for a routine transfer.

- High-Speed Transactions: These transactions prioritize faster confirmation times, often achieved through higher transaction fees. They are suitable for urgent transfers or situations where immediate confirmation is necessary. A merchant accepting Bitcoin might choose this type to ensure timely payments.

Binance Buy Bitcoin APK

The Binance Buy Bitcoin application provides a user-friendly interface for purchasing Bitcoin and other cryptocurrencies directly from your mobile device. This application streamlines the process of acquiring crypto assets, making it accessible to a broader range of users. It’s designed to be intuitive and secure, empowering users to manage their crypto holdings efficiently.

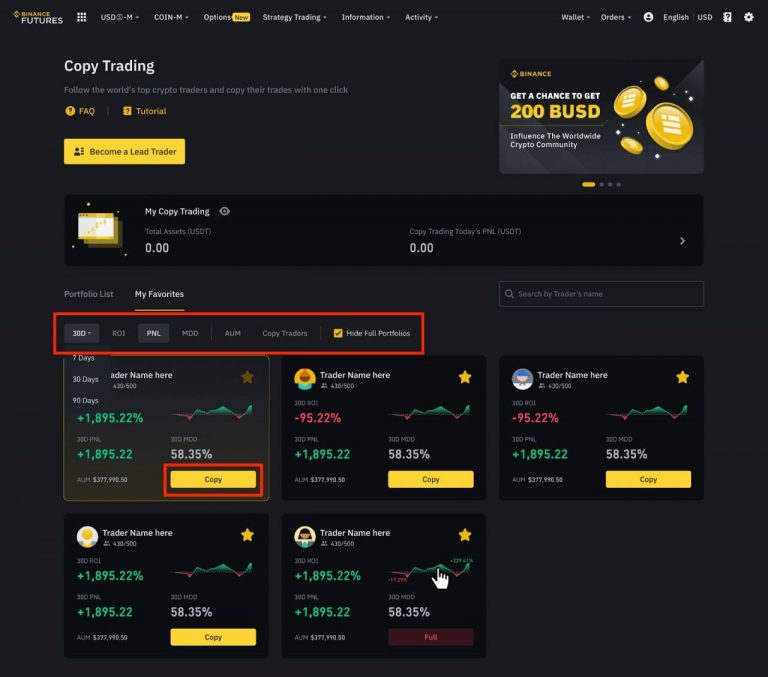

Features and Functionalities

The Binance Buy Bitcoin APK offers a comprehensive suite of features. It enables users to buy Bitcoin and other supported cryptocurrencies using various payment methods. Key functionalities include real-time price tracking, order management, and secure storage of crypto assets within the app. The app also often provides educational resources to aid in understanding the cryptocurrency market and its associated risks.

Downloading and Installing the Binance Buy Bitcoin APK

Downloading and installing the Binance Buy Bitcoin APK is a straightforward process. Users can download the APK file from the official Binance website or through authorized app stores. The installation process is typically similar to installing other Android applications. Ensure you download from trusted sources to avoid potential security risks.

Security Measures

The Binance Buy Bitcoin APK incorporates robust security measures to safeguard user funds and data. These measures include encryption protocols to protect sensitive information during transactions and secure storage of private keys. Multi-factor authentication (MFA) and regular security updates are implemented to enhance overall protection against unauthorized access. Binance maintains a dedicated security team to address vulnerabilities and protect users’ assets.

Buying Bitcoin Using the Binance Buy Bitcoin Application

The process of purchasing Bitcoin using the Binance Buy Bitcoin application is generally user-friendly. A typical workflow involves selecting Bitcoin as the desired cryptocurrency, specifying the purchase amount, choosing a payment method, and confirming the transaction. The app usually provides real-time transaction updates and confirmations. Users should always double-check transaction details before proceeding.

Comparison of Different Bitcoin Buying Methods

Different methods for purchasing Bitcoin through the Binance Buy Bitcoin APK vary in terms of transaction fees, speed, and availability. For example, credit card purchases might be faster but incur higher fees compared to bank transfers. The app often provides clear details about the fees associated with each method. Users should compare the different options to find the most suitable method for their needs.

Pros and Cons of Using the Binance Buy Bitcoin APK

| Pros | Cons |

|---|---|

| User-friendly interface | Potential for technical issues during transactions |

| Wide range of payment methods | Dependence on internet connectivity |

| Real-time price tracking | Potential security risks if not used carefully |

| Secure storage of crypto assets | Fees associated with certain payment methods |

| Educational resources available | Transaction limits may apply |

Alternatives to Binance Buy Bitcoin APK

Beyond Binance, several other applications facilitate Bitcoin and cryptocurrency purchases. These alternatives offer varying features, security protocols, and user experiences, catering to different needs and preferences. Understanding these options allows users to make informed decisions regarding their digital asset acquisition strategies.

Alternative Applications for Bitcoin Purchases

Several mobile applications provide alternative avenues for purchasing Bitcoin. These include Coinbase, Gemini, Kraken, and others. Each platform offers unique strengths and weaknesses, influencing user choice.

Features and Functionalities of Alternative Applications

Different applications offer varying levels of functionality. Coinbase, for instance, is known for its user-friendly interface and comprehensive educational resources. Gemini emphasizes security and institutional-grade features. Kraken, on the other hand, is geared toward experienced traders with a focus on advanced charting tools and order types. The features and functionalities cater to diverse user needs and levels of experience.

Security Measures of Alternative Applications

Security is a paramount concern when dealing with digital assets. Coinbase, Gemini, and Kraken have robust security measures in place, including multi-factor authentication, secure storage, and regular security audits. These measures aim to protect user funds and data from unauthorized access. While security protocols vary, all reputable platforms prioritize user protection.

User Experience of Alternative Applications

User experience varies across these applications. Coinbase often receives praise for its intuitive interface and easy navigation. Gemini, known for its focus on institutional users, may have a slightly more complex interface for beginners. Kraken, geared toward experienced traders, provides a more technical user experience. The user interface often aligns with the platform’s target user base.

Fees Associated with Using Alternative Applications

Transaction fees associated with Bitcoin purchases vary among platforms. These fees are typically categorized as per-transaction fees, network fees, and platform fees. While precise figures depend on the specific transaction and current market conditions, users should be aware of these fees to manage their costs effectively.

Comparison Table of Bitcoin Buying Applications

| Application | Features | Security | User Experience | Fees |

|---|---|---|---|---|

| Coinbase | User-friendly interface, educational resources | Robust security measures | Intuitive and easy to navigate | Variable, depending on transaction type |

| Gemini | Security-focused, institutional-grade features | High security standards | Potentially more complex for beginners | Variable, depending on transaction type |

| Kraken | Advanced charting tools, order types | Strong security protocols | More technical, geared toward experienced traders | Variable, depending on transaction type |

| Other (e.g., Cash App, PayPal) | Integration with existing payment systems | Varying security levels | Ease of integration with existing accounts | Variable, depending on transaction type and platform |

Buy Bitcoin in General

Beyond dedicated applications, various methods exist for acquiring Bitcoin. Understanding these alternatives allows for a broader perspective on acquiring this cryptocurrency. Choosing the right method depends on individual needs, risk tolerance, and comfort level with different platforms.

Methods for Buying Bitcoin Outside Specific Applications

Several avenues outside dedicated apps facilitate Bitcoin purchases. These include traditional financial institutions, cryptocurrency exchanges, and brokerage platforms. Each method offers distinct advantages and disadvantages, influencing the selection process.

Buying Bitcoin Through Exchanges

Cryptocurrency exchanges are popular platforms for buying and selling Bitcoin. They often provide a wide range of trading options and are frequently used by both novice and experienced traders. These exchanges facilitate transactions between buyers and sellers, acting as a central marketplace. Fees and transaction times vary between exchanges. An understanding of exchange features is crucial for efficient trading.

Buying Bitcoin Through a Broker

Brokerage platforms, increasingly, offer Bitcoin trading alongside traditional financial instruments. This approach combines familiarity with established financial systems with cryptocurrency investment. Navigating brokerage platforms requires familiarity with their specific Bitcoin trading procedures. The process generally involves opening an account, depositing funds, and executing a purchase order.

Payment Methods for Buying Bitcoin

A variety of payment methods support Bitcoin purchases. These can range from bank transfers and credit/debit cards to digital wallets. Each method carries specific transaction fees and limitations. For example, bank transfers can be slower than credit card transactions, and certain regions might have limitations on specific payment options. Users should thoroughly review available payment options on a platform to ensure compatibility with their financial needs.

Factors to Consider When Choosing a Bitcoin Buying Method

Selecting the optimal Bitcoin purchase method involves several key considerations. Transaction fees, security measures, platform reputation, and user experience should be evaluated. Ease of use, speed, and security are important elements. The user should carefully assess these factors to choose a method aligning with their requirements.

- Transaction Fees: Different platforms charge varying fees. Understanding these fees, including transaction and platform fees, is crucial for accurate cost estimation. Be aware that fees can fluctuate depending on factors like volume and transaction type.

- Security Measures: The platform’s security protocols are essential. Consider the security measures employed, such as two-factor authentication, encryption, and compliance with regulatory standards. A robust security framework safeguards investments.

- Platform Reputation: Thoroughly researching the platform’s reputation is paramount. Check user reviews, examine regulatory compliance, and consider the platform’s history to evaluate its reliability and trustworthiness. This step reduces the risk of encountering fraudulent or unstable platforms.

- User Experience: The platform’s user-friendliness significantly influences the overall buying experience. An intuitive interface and clear instructions contribute to a seamless process. Simplicity and accessibility are important elements to evaluate.

- Ease of Use: The platform’s ease of use is crucial. A user-friendly interface simplifies navigation and transaction execution. This factor reduces complexity and enhances the overall experience.

- Speed: Transaction speed is a critical aspect. Faster transactions minimize delays and provide more efficient access to funds. Real-time updates and quick processing are essential for a seamless experience.

- Security: The platform’s security measures safeguard investments. Thorough security protocols, including encryption and two-factor authentication, are crucial for protecting assets. Robust security measures mitigate the risk of unauthorized access.

Security Considerations in Buying Bitcoin

Protecting Bitcoin investments requires vigilance. Security breaches can lead to substantial financial losses. Practicing good security habits is paramount. Be cautious about phishing scams, malware, and other security threats. Implementing robust security measures protects investments and safeguards personal information.

Important Considerations

Bitcoin transactions are irreversible. Once a transaction is confirmed, it cannot be reversed. Thorough verification of addresses and transaction details is essential to prevent errors.

Security and Risks of Buying Bitcoin

Bitcoin, while offering potential financial gains, comes with inherent security risks. Understanding these risks and implementing appropriate safeguards is crucial for any investor. This section delves into the common security vulnerabilities associated with Bitcoin purchases, from scams to the importance of safeguarding your private keys.The decentralized nature of Bitcoin, while a strength in many ways, can also make it vulnerable to fraud and malicious actors.

Investors must be vigilant and aware of the various methods employed by scammers to exploit unsuspecting users. A lack of regulation in the cryptocurrency market can also contribute to these vulnerabilities.

Common Security Risks

Bitcoin transactions, while transparent on the blockchain, are susceptible to various security threats. These include phishing scams, malware, and the ever-present risk of theft. Malicious actors often exploit the lack of user education to gain access to sensitive information.

Common Scams and Fraudulent Activities

Numerous scams target Bitcoin investors. Phishing attempts often trick users into revealing their private keys or login credentials to fraudulent websites. Fake investment opportunities, promising unrealistic returns, are also prevalent. Furthermore, scams can involve the creation of counterfeit Bitcoin or cryptocurrency exchanges. Users should always verify the legitimacy of any platform before investing.

Verifying the Legitimacy of Bitcoin Platforms

Before investing in any Bitcoin platform, thorough verification is essential. Scrutinize the platform’s security measures, user reviews, and licensing status. Look for established regulatory compliance and transparency in operations. Do not be swayed by overly aggressive marketing or promises of extraordinary returns.

Protecting Your Bitcoin Investment from Theft

Protecting your Bitcoin investment requires a multi-layered approach. Strong passwords, two-factor authentication, and regularly updated security software are essential. Be cautious about clicking on suspicious links or downloading untrusted applications. Keeping your software up-to-date is crucial, as vulnerabilities can be exploited. Consider using a hardware wallet for secure offline storage of your private keys.

Best Practices for Securing Your Bitcoin Purchases

Maintaining a high level of security is paramount when dealing with Bitcoin. A robust security strategy should include the following:

- Use strong, unique passwords for all your accounts.

- Enable two-factor authentication (2FA) wherever possible.

- Regularly update your software and operating systems to patch vulnerabilities.

- Be wary of unsolicited emails or messages promising high returns.

- Avoid using public Wi-Fi for sensitive transactions.

- Be extremely cautious of links in unsolicited emails or messages.

- Avoid clicking on links from unknown senders.

- Always verify the legitimacy of a platform before investing.

Storing Your Private Keys Securely

Your private keys are the keys to your Bitcoin fortune. Losing them means losing your investment. Never share your private keys with anyone. Consider using a reputable hardware wallet for offline storage. These devices offer enhanced security compared to software wallets.

Ensure your private keys are stored in a safe, secure location, preferably offline.

“Protecting your private keys is paramount to preserving your Bitcoin holdings.”

User Experience and Reviews

The user experience of a cryptocurrency application like Binance Buy Bitcoin APK is crucial for its success. User reviews provide valuable insights into the strengths and weaknesses of the platform, informing potential users about the application’s practicality and reliability. Analyzing user experiences allows for a comparison with alternative applications and pinpoints key elements contributing to a positive user experience.

User Experience of Binance Buy Bitcoin APK

The user experience of Binance Buy Bitcoin APK is generally considered straightforward, with many users praising its intuitive interface. This ease of navigation allows users to quickly find the necessary functions for purchasing Bitcoin and other cryptocurrencies. However, some users have reported occasional glitches or slow loading times, especially during peak trading periods. The application’s performance, especially during periods of high user activity, is a recurring concern in user reviews.

Common User Reviews and Feedback

Positive user reviews often highlight the platform’s wide range of cryptocurrencies available, ease of navigation, and robust security features. Negative feedback frequently focuses on issues such as the complexity of certain features, inconsistent transaction processing times, and difficulties with customer support. Specific concerns regarding the application’s performance during high-volume periods, and the level of customer support available, are prevalent in user reviews.

Comparison with Alternative Applications

Compared to alternative applications, Binance Buy Bitcoin APK generally scores well in terms of the variety of cryptocurrencies supported. However, competitors may excel in specific areas, such as faster transaction speeds or more user-friendly mobile wallets. A comprehensive comparison should consider not just the buying process but also aspects like transaction fees, security measures, and customer support availability.

The diverse user experiences and preferences regarding crypto apps influence the choice of application.

Key Elements Contributing to a Positive User Experience

A positive user experience hinges on several key elements. A user-friendly interface, reliable transaction processing, responsive customer support, and clear terms and conditions contribute to a seamless and trustworthy user experience. High security measures, along with transparency in the platform’s operations, are also vital factors in shaping a positive user experience.

Summary of User Reviews and Ratings

| Rating | Frequency | Common Themes |

|---|---|---|

| 5 Stars | High | Ease of use, wide cryptocurrency selection, secure platform |

| 4 Stars | Moderate | Occasional glitches, slow transaction times, some complexities in certain features |

| 3 Stars | Low | Significant transaction delays, unreliable customer support, unclear platform policies |

Summary of User Opinions on Ease of Use

User feedback indicates that the Binance Buy Bitcoin APK is generally easy to use, with a straightforward interface. However, some users found certain features or processes somewhat complex, while others encountered problems with the app’s responsiveness. Overall, the ease of use is considered satisfactory by most users, but areas for improvement in specific functionalities are noted.

Technical Aspects

The Binance Buy Bitcoin application relies on a robust technical foundation to facilitate secure and efficient cryptocurrency transactions. Understanding the underlying technology is crucial for users to appreciate the complexities and potential risks involved. This section delves into the specifics of the application’s architecture, the vital role of blockchain and cryptography, and the types of cryptocurrencies supported.The Binance Buy Bitcoin application utilizes a client-server architecture.

The client application, installed on the user’s device, interacts with the Binance platform’s servers. This interaction is mediated through secure communication protocols to safeguard user data and transactions.

Application Architecture and Technology

The Binance Buy Bitcoin application is built on a layered architecture. The presentation layer handles the user interface, enabling users to interact with the platform intuitively. The application logic layer manages the transactions and data flow. The data access layer connects to the Binance platform’s databases and APIs, handling the retrieval and storage of necessary information. Modern programming languages and frameworks are employed to ensure the application’s performance and scalability.

Blockchain Technology in Bitcoin Transactions

Blockchain technology underpins Bitcoin transactions. Each transaction is recorded on a shared, immutable ledger, distributed across a network of computers. This decentralized approach enhances transparency and security. Bitcoin’s blockchain is designed to prevent double-spending and maintain a consistent, verifiable record of transactions.

Cryptography in Securing Bitcoin Transactions

Cryptography plays a critical role in securing Bitcoin transactions. Digital signatures and encryption techniques ensure the integrity and authenticity of transactions. These methods protect against unauthorized access and modification of sensitive information. Cryptography is fundamental to the security of the Bitcoin network.

Types of Cryptocurrencies Supported

The Binance Buy Bitcoin application supports a range of cryptocurrencies beyond Bitcoin. This includes other prominent crypto assets, altcoins, and stablecoins. The application’s capabilities extend to facilitate the purchase of these varied digital assets. This broad support enhances the platform’s versatility and caters to a diverse range of user preferences.

Connection to the Binance Platform

The Binance Buy Bitcoin application interfaces with the Binance platform through Application Programming Interfaces (APIs). These APIs provide a secure and efficient channel for the application to access the Binance platform’s services. The APIs facilitate the exchange of data, the execution of transactions, and the retrieval of real-time market information.

Summary

In conclusion, Binance Buy Bitcoin and Crypto APK presents a convenient avenue for Bitcoin and crypto acquisition. However, careful consideration of security measures and alternative options is crucial. Understanding the broader landscape of Bitcoin purchasing methods empowers informed decisions, ultimately leading to a more secure and satisfying crypto experience. This guide serves as a starting point for those navigating the world of digital assets.

FAQs

Is Binance Buy Bitcoin APK secure?

Binance employs robust security measures to protect user data and transactions. However, as with any financial transaction, users should adhere to best practices for online security.

What are the fees associated with using Binance Buy Bitcoin APK?

Transaction fees vary, and it’s essential to review the current fee structure on the Binance platform. Factors like transaction amount and payment method can influence the final cost.

What are some alternative apps for buying Bitcoin?

Other popular apps include Coinbase, Kraken, and Gemini, each with its own set of features and fees. Comparison shopping across these platforms is recommended.

What are the different methods for buying Bitcoin outside of specific applications?

Buying Bitcoin through cryptocurrency exchanges, brokers, and peer-to-peer platforms are common methods. Each option has its own set of advantages and disadvantages.