The integration of cryptocurrencies into mainstream payment systems is rapidly evolving. This exploration delves into the feasibility of purchasing Bitcoin using Apple Pay, examining both the potential benefits and inherent limitations. We’ll also consider alternative methods and the broader implications for the future of digital finance.

Bitcoin, a decentralized digital currency, has gained significant traction. Understanding the nuances of acquiring Bitcoin, particularly through Apple Pay, requires a comprehensive overview of its acquisition methods and associated security considerations.

Introduction to Bitcoin Purchasing

Bitcoin, a decentralized digital currency, operates independently of central banks and traditional financial institutions. Its value is determined by supply and demand within a global marketplace. This contrasts with traditional fiat currencies, which are backed by governments. Bitcoin’s unique characteristics have made it an attractive asset for investment and transactions, but also one requiring careful consideration for purchase.Bitcoin acquisition methods encompass a range of platforms and services.

These vary from direct exchanges where users buy and sell cryptocurrencies to brokerages that offer Bitcoin as an investment option. The accessibility and user experience differ significantly among these various methods, so understanding the nuances is crucial. Careful consideration is essential to ensure a secure and profitable acquisition process.

Methods of Acquiring Bitcoin

Various methods exist for acquiring Bitcoin, each with its own set of advantages and disadvantages. Direct exchange platforms allow for direct interaction between buyers and sellers, often at fluctuating prices. Brokerages, on the other hand, offer a regulated environment with potentially lower transaction fees but might limit access to specific trading pairs. Finally, peer-to-peer (P2P) exchanges offer direct transactions between individuals, often bypassing intermediaries, potentially resulting in lower fees but increasing the risk.

Key Considerations When Purchasing Bitcoin

Several key factors are crucial when considering the purchase of Bitcoin. Security is paramount, as Bitcoin transactions are often irreversible. Choosing a reputable platform with robust security measures is vital. Transaction fees, which can vary considerably between platforms, should also be evaluated. Understanding the platform’s user experience and ease of navigation is essential for a smooth transaction.

Bitcoin Purchase Platform Comparison

| Platform | Fees | Security | User Experience |

|---|---|---|---|

| Coinbase | Variable, often tiered based on volume | High, with robust security protocols and 2FA | Generally user-friendly, with a comprehensive interface and support resources |

| Kraken | Variable, competitive with other major exchanges | High, employing advanced security measures | Generally well-regarded for its advanced trading tools and features |

| Binance | Generally lower, particularly for high-volume traders | High, with robust security protocols | Known for its extensive range of trading pairs and features, but can be complex for beginners |

| LocalBitcoins | Often lower than major exchanges | Lower compared to exchanges, users are responsible for verifying seller legitimacy | Can be less intuitive, as it involves direct communication and transactions with other users |

This table provides a concise comparison of various Bitcoin purchase platforms, highlighting key factors for potential buyers. Choosing a platform should depend on individual priorities and risk tolerance. For instance, a user prioritizing security might favor Coinbase or Kraken, while a user seeking lower fees might prefer LocalBitcoins.

Bitcoin Purchasing on Apple Pay

Integrating Bitcoin into mainstream payment systems like Apple Pay presents a compelling prospect. This integration could significantly expand Bitcoin’s accessibility and potentially drive wider adoption. However, several practical and technical hurdles need careful consideration.Cryptocurrencies like Bitcoin operate independently of traditional financial systems, relying on decentralized networks for transaction processing. Their integration with established payment platforms like Apple Pay necessitates a bridge between these distinct models.

Apple Pay, on the other hand, leverages existing infrastructure for secure and efficient mobile payments. This juxtaposition presents unique opportunities and challenges for Bitcoin adoption.

Cryptocurrency and Payment System Integration

Cryptocurrencies like Bitcoin utilize blockchain technology, which ensures secure and transparent transaction recording. This distributed ledger system, while offering security and immutability, can be complex to integrate with the existing structure of centralized payment systems. Furthermore, the volatility of cryptocurrency values, a well-known characteristic, needs to be addressed to create a seamless user experience. The volatility can introduce price fluctuations, potentially impacting the transaction value for users.

Features and Functionalities of Apple Pay

Apple Pay is a mobile payment platform that enables secure transactions using various payment methods, including credit cards, debit cards, and digital wallets. It leverages a robust security framework, including tokenization and encryption, to protect user data. Key features include seamless integration with iOS devices and support for contactless payments. The platform is known for its user-friendly interface and established security protocols.

Potential Benefits of Bitcoin Using Apple Pay

The integration of Bitcoin with Apple Pay has the potential to greatly expand Bitcoin’s accessibility. This broader accessibility could lead to increased participation in the cryptocurrency market, potentially stimulating innovation and development within the sector. Increased accessibility could also lower barriers to entry for retail investors seeking exposure to cryptocurrencies.

Technical Challenges in Enabling Bitcoin Purchases on Apple Pay

Several technical challenges hinder the seamless integration of Bitcoin purchases into Apple Pay. One critical hurdle is the security and scalability of blockchain transactions. The high transaction volume and speed requirements of a mainstream payment system like Apple Pay might not align with the current capabilities of the Bitcoin network. Maintaining the security of both Bitcoin wallets and the Apple Pay system in a combined environment is another major concern.

Comparison of Security Measures

Apple Pay employs robust security measures, including tokenization and encryption, to safeguard user data. Similar security measures are required for Bitcoin transactions to ensure user funds are protected. While Apple Pay benefits from the established security infrastructure of its existing payment network, Bitcoin transactions involve a different security paradigm, which needs to be carefully addressed.

Advantages and Disadvantages of Apple Pay for Bitcoin Purchases

| Feature | Advantages | Disadvantages |

|---|---|---|

| Security | Apple Pay’s established security protocols can enhance user confidence. | Bitcoin transactions require careful management of private keys to avoid losses. |

| Accessibility | Wide user base for Apple Pay enhances potential Bitcoin adoption. | Bitcoin network’s capacity and transaction speed may pose limitations. |

| User Experience | Familiar user interface for Apple Pay could ease Bitcoin adoption. | Technical integration complexities might create a less user-friendly experience. |

| Scalability | Apple Pay’s established infrastructure can potentially handle increased transaction volume. | Bitcoin network’s scalability is a potential constraint for high-volume transactions. |

Exploring Alternatives to Apple Pay for Bitcoin Purchases

Beyond Apple Pay, a diverse range of platforms facilitates Bitcoin acquisition. Understanding these alternatives provides a broader perspective on Bitcoin accessibility and empowers users to choose the most suitable method based on individual needs and preferences. Different platforms cater to various user profiles, from beginners to experienced investors.This exploration delves into several alternative platforms, outlining their advantages and disadvantages.

We will also analyze security measures and payment options, ultimately aiding in the informed decision-making process.

Alternative Bitcoin Purchase Platforms

Numerous platforms allow Bitcoin purchases, offering varying degrees of convenience and security. This section provides a concise overview of key players in the Bitcoin ecosystem.

- Crypto.com: A comprehensive cryptocurrency platform that supports buying and selling Bitcoin alongside a wide range of other cryptocurrencies. It offers competitive fees, a user-friendly interface, and various security measures, including two-factor authentication and cold storage for funds. A significant advantage is its integrated suite of financial products like debit cards and savings accounts.

- Coinbase: A prominent cryptocurrency exchange, Coinbase is well-established and trusted. It provides a straightforward user experience, making it accessible to both beginners and experienced users. However, fees may vary, and certain features may be exclusive to premium users.

- Kraken: Known for its advanced features, Kraken targets experienced users and traders. Its platform is sophisticated, enabling complex trading strategies and advanced order types. Fees are generally competitive, but navigating the platform may require some technical understanding.

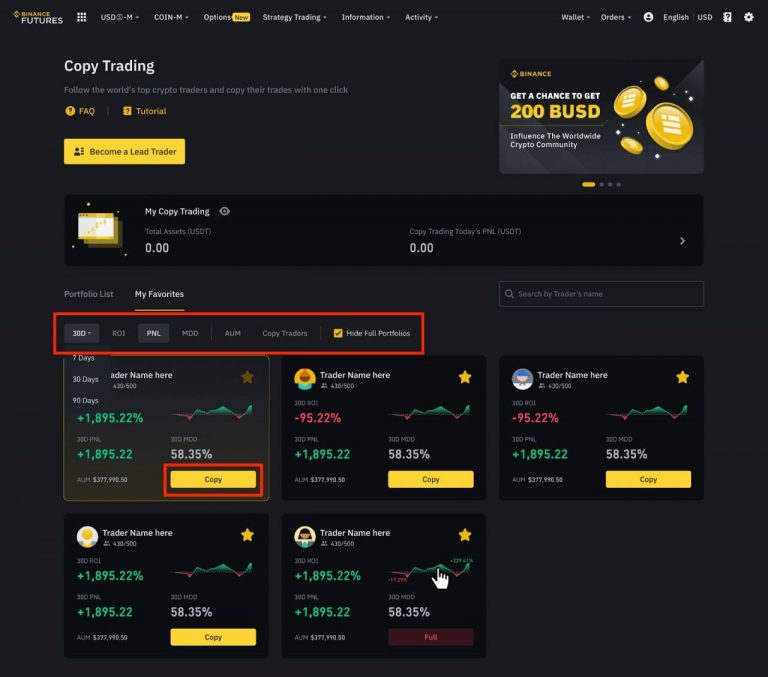

- Binance: One of the largest cryptocurrency exchanges globally, Binance offers a vast array of cryptocurrencies and trading options. While user-friendly, it can be overwhelming for newcomers due to its extensive features. Security measures are robust, but the platform’s global reach introduces potential regulatory complexities in some regions.

Comparison of Bitcoin Exchanges

A comparative analysis aids in choosing the optimal platform for Bitcoin purchases.

| Exchange | Fees | Security | User Interface |

|---|---|---|---|

| Crypto.com | Competitive, tiered | Robust, multi-layered | Intuitive, user-friendly |

| Coinbase | Generally moderate | Strong, industry-standard | Simple, straightforward |

| Kraken | Competitive, tiered | Excellent, advanced security protocols | Complex, suitable for experienced users |

| Binance | Competitive, tiered | Strong, sophisticated | Vast, extensive, may be overwhelming for beginners |

Bitcoin Purchase Methods Beyond Apple Pay

Alternative payment methods exist for Bitcoin purchases.

- Debit/Credit Cards: Many exchanges directly accept debit and credit cards for Bitcoin purchases. This provides a seamless and readily accessible option for users familiar with these methods. Transaction fees may vary.

- Bank Transfers: Some exchanges allow Bitcoin purchases via bank transfers. This method can be slower than card transactions, and may incur additional fees or restrictions.

- Other Cryptocurrency: Exchanges often facilitate trading between various cryptocurrencies. This allows users to exchange other crypto holdings for Bitcoin.

Security Measures on Bitcoin Exchanges

Security is paramount in the cryptocurrency world.

- Multi-Factor Authentication (MFA): Implementing MFA adds a layer of protection, requiring users to verify their identity through multiple methods.

- Cold Storage: Storing a portion of funds offline (cold storage) minimizes the risk of hacking and enhances security.

- Regular Security Audits: Proactive security audits identify and mitigate potential vulnerabilities. These are often industry-standard procedures to ensure platform security.

The Future of Bitcoin and Payment Systems

The Bitcoin market and its integration with payment systems are evolving rapidly. Predicting the future precisely is challenging, but examining current trends and potential developments provides a glimpse into the landscape ahead. Technological advancements, regulatory responses, and economic factors will all play a role in shaping Bitcoin’s trajectory.The future of Bitcoin and related payment systems will be characterized by a complex interplay of factors, including technological innovation, regulatory changes, and evolving market acceptance.

This dynamic environment will impact the way individuals and businesses interact with cryptocurrencies. The integration of cryptocurrencies with established payment apps and the development of new platforms are expected to shape future usage patterns.

Future Trends in the Bitcoin Market

Bitcoin’s market value and adoption rate have shown considerable fluctuations in recent years. Future trends will likely be influenced by factors like technological advancements, regulatory clarity, and overall market sentiment. For example, advancements in blockchain technology could potentially enhance transaction speeds and security, driving wider adoption.

Potential Future Integrations of Cryptocurrencies with Payment Apps

The integration of cryptocurrencies with popular payment applications will likely accelerate. This could involve direct support for Bitcoin transactions within apps or partnerships enabling seamless cryptocurrency payments. For instance, Apple Pay’s future expansion into crypto could significantly boost Bitcoin’s accessibility. Furthermore, decentralized payment networks could emerge, allowing for direct peer-to-peer transactions with reduced reliance on intermediaries.

Regulatory Developments Impacting Bitcoin Purchases

Regulatory frameworks surrounding Bitcoin purchases are constantly evolving. Governments worldwide are grappling with the complexities of regulating cryptocurrencies, and different approaches are being adopted. Some countries are actively developing clear regulatory frameworks to foster innovation and consumer protection. Others are taking a more cautious approach, aiming to mitigate potential risks. The specifics of these regulatory developments will greatly influence the future ease and accessibility of Bitcoin purchases.

Evolution of Bitcoin’s Role in the Financial Landscape

Bitcoin’s role in the financial landscape is undergoing a transformation. From a niche investment to a potential mainstream payment option, its trajectory is evolving. Its use as a store of value and a medium of exchange is being increasingly explored. The emergence of stablecoins and other cryptocurrencies could potentially alter Bitcoin’s dominance within the market.

Potential Impact of Wider Bitcoin Adoption on the Economy

Widespread adoption of Bitcoin could significantly impact the economy. Increased usage could lead to greater financial inclusion, particularly in underserved communities. However, potential risks include volatility and the need for robust regulatory frameworks to mitigate potential financial instability. The adoption of Bitcoin could also lead to a shift in payment processing models, impacting traditional financial institutions.

General Information on Buying Bitcoin

Bitcoin, a decentralized digital currency, has gained significant traction as a store of value and a medium of exchange. Understanding the process of buying Bitcoin, coupled with the associated security and risk factors, is crucial for any potential investor. This section provides a comprehensive overview of Bitcoin purchasing, highlighting key considerations for safe and informed transactions.Buying Bitcoin involves navigating various platforms and understanding the technical aspects of cryptocurrencies.

The process can be broken down into clear steps, from account creation to transaction completion. Security is paramount, and various precautions must be taken to mitigate potential risks.

Step-by-Step Guide to Buying Bitcoin

Understanding the process of purchasing Bitcoin is fundamental. This involves selecting a reputable platform, verifying your identity, and funding your account. A well-defined step-by-step process, Artikeld below, ensures a smooth and secure transaction.

- Choose a reputable Bitcoin exchange or broker. Research and compare different platforms, considering factors such as fees, security measures, and user reviews.

- Create an account on the chosen platform, providing accurate and complete information during the registration process. Verify your identity to comply with regulatory requirements.

- Fund your account using a supported payment method. Methods may include bank transfers, credit/debit cards, or other digital payment options.

- Place an order to buy Bitcoin. Specify the amount of Bitcoin you wish to purchase and the price you’re willing to pay. Ensure the order details are correct.

- Review and confirm the transaction. Double-check the details of the transaction, including the amount, price, and payment method, before finalizing the purchase.

Security Measures During Bitcoin Transactions

Maintaining security during Bitcoin transactions is crucial to protect your funds. Implementing strong security measures reduces the risk of fraud and theft.

- Use strong, unique passwords for your accounts and enable two-factor authentication (2FA) wherever possible. This adds an extra layer of security by requiring a second verification method, beyond just a password.

- Keep your software updated to the latest versions. Outdated software may contain vulnerabilities that can be exploited by malicious actors.

- Be wary of phishing scams. Avoid clicking on suspicious links or downloading attachments from unknown sources.

- Use a secure internet connection. Avoid using public Wi-Fi networks for sensitive transactions.

- Store your private keys securely. These keys are essential for accessing your Bitcoin, so they should be kept in a safe and secure location. Never share your private keys with anyone.

Risks Involved in Buying and Selling Bitcoin

Bitcoin trading comes with inherent risks. Understanding these risks is essential to managing your investment decisions.

- Market volatility: Bitcoin prices can fluctuate significantly, leading to potential losses if the price drops before you sell. The unpredictable nature of the cryptocurrency market should be carefully considered.

- Security breaches: Hacking or security breaches on exchanges can result in the loss of funds.

- Regulatory uncertainty: Regulations surrounding cryptocurrencies are constantly evolving, and changes in regulations can impact the value and accessibility of Bitcoin.

- Fraudulent activities: Be cautious of scams and fraudulent schemes targeting Bitcoin investors. Verify the legitimacy of any platform or individual offering Bitcoin services.

- Technical issues: Software glitches or technical problems on trading platforms can cause delays or issues with transactions.

Different Types of Bitcoin Wallets

Various types of wallets cater to different needs and security levels. Choosing the appropriate wallet depends on the level of security and functionality required.

- Software wallets: These wallets are installed on your computer or mobile device and allow you to store and manage your Bitcoin. These are convenient but require careful management of security measures to prevent theft.

- Hardware wallets: These are physical devices designed to securely store your private keys offline. This approach provides a high level of security but can be more expensive.

- Online wallets: These wallets are hosted on a third-party platform, providing ease of access but potentially compromising security if the platform is compromised.

Common Terms Related to Bitcoin Purchases

Understanding common terminology related to Bitcoin purchases facilitates better communication and navigation within the cryptocurrency ecosystem.

| Term | Definition |

|---|---|

| Bitcoin Exchange | A platform where users can buy and sell Bitcoin. |

| Order Book | A list of buy and sell orders for Bitcoin on an exchange. |

| Market Order | An order to buy or sell Bitcoin at the current market price. |

| Limit Order | An order to buy or sell Bitcoin at a specific price or better. |

| Fees | Charges associated with Bitcoin transactions on exchanges. |

Illustrative Examples of Bitcoin Transactions

Bitcoin transactions, while seemingly simple, involve complex processes and potential security risks. Understanding these transactions through practical examples is crucial for navigating the cryptocurrency landscape safely and effectively. This section provides illustrative examples, showcasing both successful and potentially problematic transactions.Understanding the diverse methods for Bitcoin purchases, along with the security measures and compliance aspects involved, is vital for safe participation in the Bitcoin ecosystem.

Scenario of a Bitcoin Purchase Using a Specific Method

A user, Sarah, wishes to purchase Bitcoin using a reputable cryptocurrency exchange. She accesses the exchange’s platform via a secure web browser. She verifies her identity and fund sources through the exchange’s KYC (Know Your Customer) process. Following these procedures, Sarah initiates a transaction to buy Bitcoin using her bank account. The exchange verifies the transaction, and Bitcoin is credited to Sarah’s exchange account.

Scenario Highlighting a Potential Security Risk in Bitcoin Transactions

A user, David, attempts to purchase Bitcoin using a non-verified, or poorly secured, platform. The platform lacks robust security measures, and David’s sensitive financial information, including his login credentials, is compromised. Malicious actors gain access to David’s account, transferring his Bitcoin to their own accounts. This highlights the critical importance of using verified and secure platforms for Bitcoin transactions.

Example of a Transaction Using a Cryptocurrency Exchange

Consider a transaction on Coinbase, a well-known cryptocurrency exchange. A user, Michael, wants to purchase 1 Bitcoin. He initiates the transaction from his Coinbase account, specifying the amount and selecting his preferred payment method (e.g., bank transfer). Coinbase verifies the payment, and the Bitcoin is credited to Michael’s account within a few minutes. This is a common example of a transaction using a secure and regulated exchange.

Detailed Description of a Typical Bitcoin Purchase Workflow, Focusing on Security and Compliance Aspects

A typical Bitcoin purchase workflow involves several steps, emphasizing security and compliance. First, the buyer selects a reputable exchange or platform. Crucially, the buyer should verify the exchange’s legitimacy and compliance with relevant regulations. The platform verifies the buyer’s identity (KYC) and payment source. The buyer then initiates the transaction, providing the necessary details and authorizing the payment.

The exchange verifies the transaction, and the Bitcoin is transferred to the buyer’s account. This process generally involves securing user data through encryption and multi-factor authentication.

How Bitcoin Transactions Are Recorded and Tracked

Bitcoin transactions are recorded on a public ledger called the blockchain. Each transaction is cryptographically linked to the previous one, creating a chronological and immutable record. This decentralized ledger allows for transparency and traceability of Bitcoin movements. Every transaction is publicly viewable on the blockchain, making it a transparent system, although user privacy can still be maintained by using privacy-enhancing technologies.

Comparing Bitcoin to Traditional Currencies

Bitcoin, a digital or cryptocurrency, differs significantly from traditional currencies like the US dollar or the Euro. These differences stem from Bitcoin’s decentralized nature, its underlying technology, and the unique market forces influencing its value. Understanding these distinctions is crucial for anyone considering Bitcoin as an investment or a form of payment.Traditional currencies, issued and regulated by central banks, enjoy a degree of stability and trust derived from government backing.

Bitcoin, on the other hand, operates on a decentralized network, making it less susceptible to government intervention but also exposing it to greater market volatility. This inherent difference in structure shapes how both assets are perceived and managed.

Key Differences Between Bitcoin and Traditional Currencies

Traditional currencies are issued and regulated by central banks, offering a degree of stability and trust due to government backing. Bitcoin, a decentralized digital currency, operates independently of governments, potentially offering greater freedom from intervention but also higher volatility. This fundamental distinction shapes their respective roles in the financial landscape.

| Characteristic | Bitcoin | Traditional Currency |

|---|---|---|

| Issuer | Decentralized network | Central bank |

| Regulation | Limited government regulation | Extensive government regulation |

| Volatility | High | Generally lower |

| Transaction Speed | Relatively fast | Variable, often slower for international transactions |

| Security | Cryptographically secured, but susceptible to hacking | Generally secure, with measures to prevent fraud |

| Inflation | Fixed supply (21 million coins) | Potentially subject to inflation |

Bitcoin Price Volatility

Bitcoin’s price has historically exhibited significant volatility, fluctuating wildly over short periods. This volatility, unlike the more stable fluctuations of traditional currencies, is driven by various factors, including market sentiment, regulatory changes, and technological advancements. For example, news about Bitcoin mining difficulty adjustments or regulatory pronouncements can significantly affect its price. Comparing this to the more predictable movements of traditional currencies, like the US dollar, highlights a crucial difference.

Bitcoin as a Store of Value

Bitcoin’s potential as a store of value is a subject of ongoing debate. While its limited supply might suggest its capacity to retain or increase value over time, its significant price fluctuations present a considerable risk. The potential advantages of Bitcoin as a store of value stem from its decentralized and potentially inflation-resistant nature. Conversely, the substantial price volatility introduces substantial risk, which is absent in traditional assets.

The historical record of Bitcoin price fluctuations underscores this risk.

Factors Influencing Bitcoin Price Fluctuations

Several factors contribute to the price volatility of Bitcoin. Market sentiment plays a significant role, with positive or negative news affecting the demand for the asset. Regulatory developments, such as new laws or regulations impacting cryptocurrencies, can significantly affect the price. Technological advancements in the Bitcoin network or competing cryptocurrencies also influence its value. These factors create a dynamic and unpredictable environment for Bitcoin investors.

The unpredictable nature of these factors is a crucial point to consider.

Conclusion

In conclusion, while the possibility of purchasing Bitcoin through Apple Pay remains uncertain, several alternative platforms offer viable solutions. This discussion highlights the complexities of integrating cryptocurrencies into established payment systems, emphasizing the need for robust security measures and regulatory clarity. The future of Bitcoin integration within consumer payment ecosystems remains an evolving landscape, requiring ongoing attention to technological advancements and regulatory developments.

Helpful Answers

Can I use my existing Apple Pay balance to buy Bitcoin?

No, Apple Pay is primarily designed for traditional payment methods. Bitcoin purchases typically require a separate cryptocurrency wallet or exchange platform.

What are the security concerns when purchasing Bitcoin?

Security is paramount. Be wary of phishing scams and choose reputable platforms with strong security measures. Always store your private keys securely.

Are there any fees associated with buying Bitcoin through alternative platforms?

Yes, most platforms charge fees, often depending on the transaction amount and method. Research and compare these fees across different platforms.

What are the potential future trends for Bitcoin and payment systems?

The future likely involves greater integration of cryptocurrencies into payment apps, potentially through seamless interoperability. Regulatory frameworks will play a critical role in shaping this integration.